In this post:

Is your cash flow runway ready for liftoff?

This is the question Halley, our Director of Marketing, wants to help you figure out.

If you don’t know what we mean by “cashflow runway,” we’re definitely not talking about planes, trains, or automobiles. We’re talking about creating a strategic way to fund your eCommerce brand—this is your cash flow runway.

A lot of business owners don’t look at this. They just look at their bank accounts and see their balance, and take this information at face value. What they’re overlooking is the timeline for how long that cash is going to last. This is especially important to think about when you’re thinking about ways to grow your eCommerce business.

Your cash flow runway is a crucial component of growth that a lot of founders and store owners ignore. Don’t be one of them!

What is an eCommerce cash flow runway?

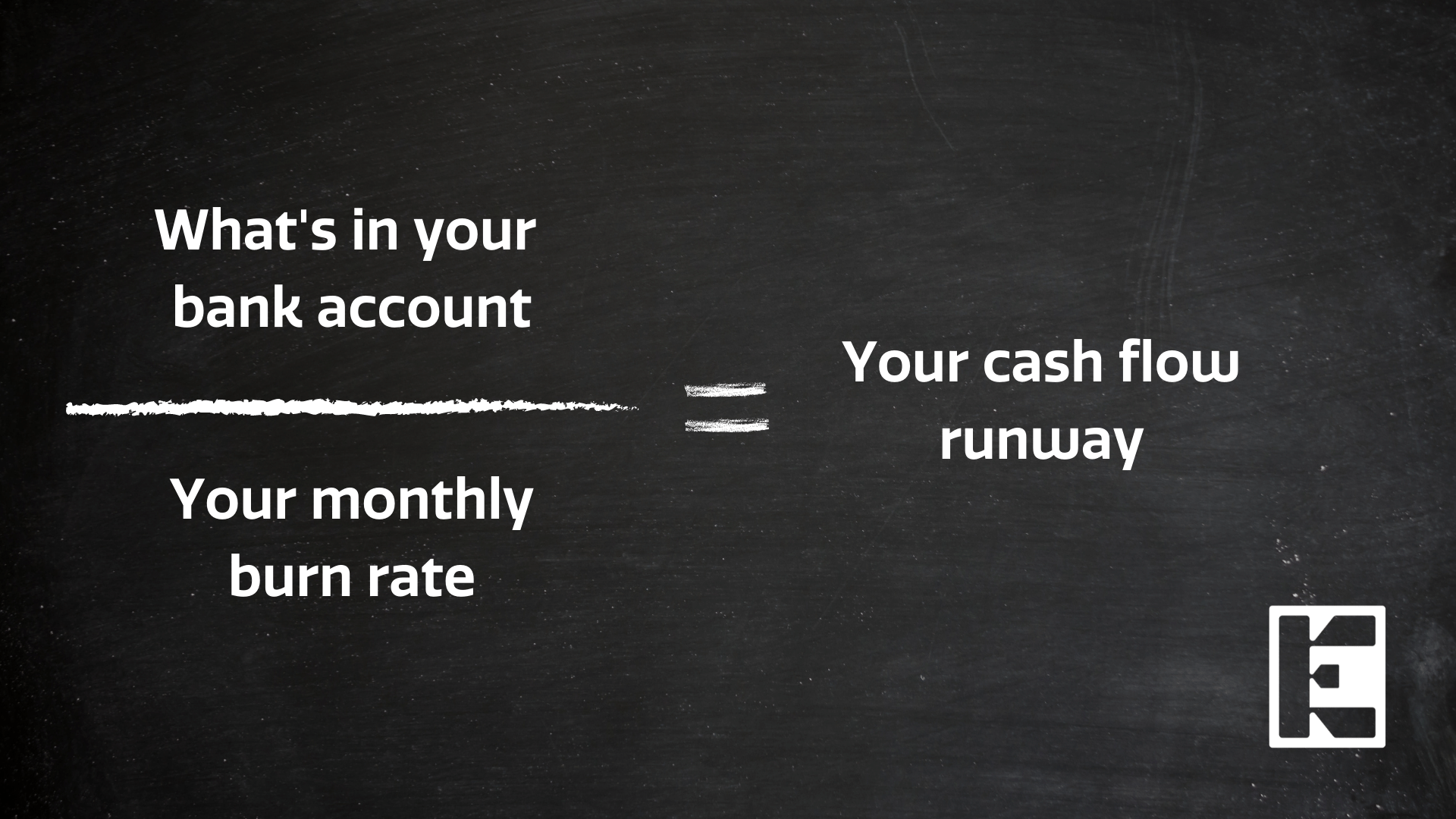

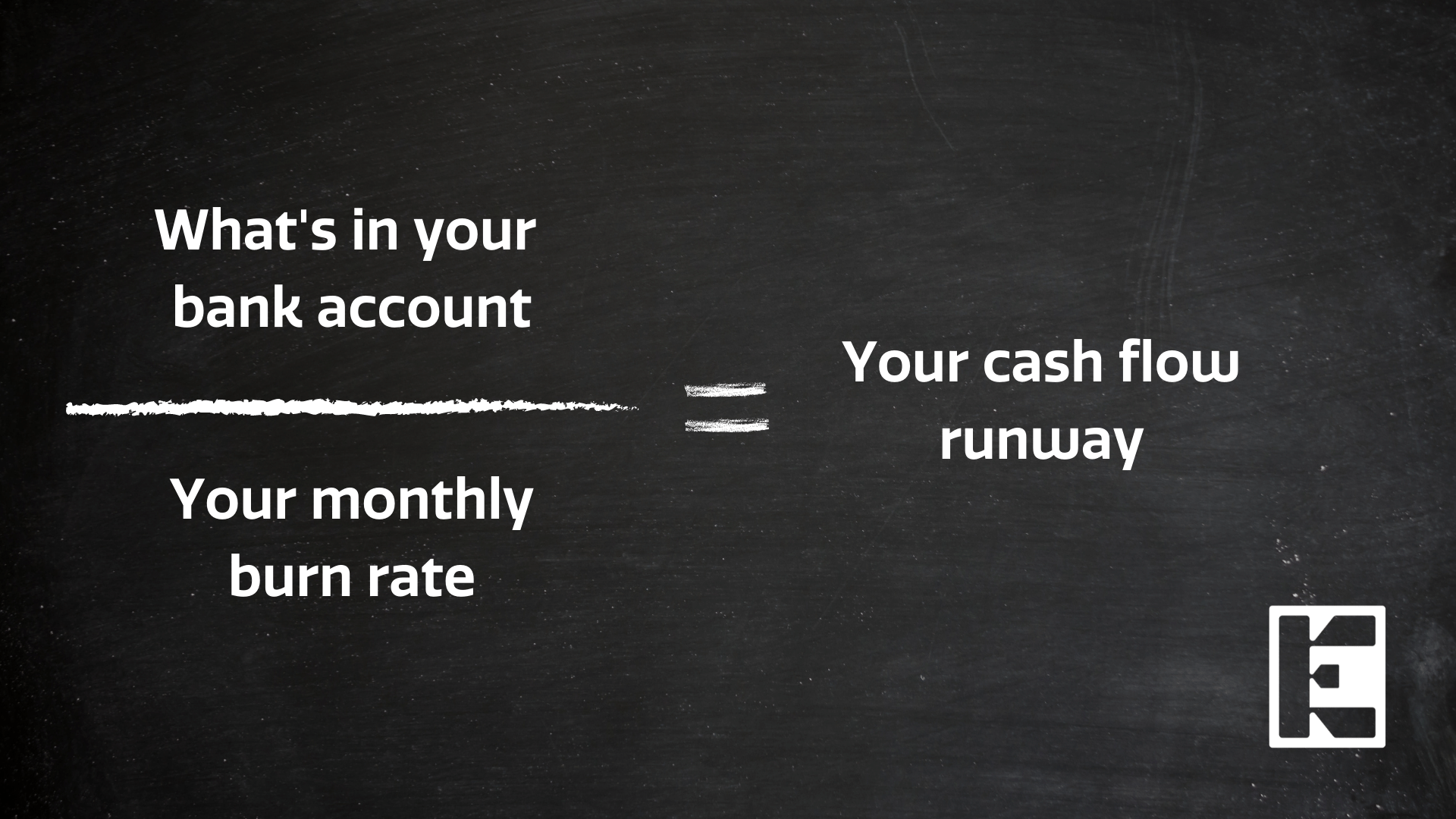

In short, your cash flow is how much money you have, divided by the monthly costs of running your business (sometimes referred to as “burn rate”).

So if you have $200,000 in the bank and it costs $50,000 per month to keep your business running, you have a four-month cash flow runway.

This is a simple formula for a very important piece of information! Your cash flow calculation helps you see where (and when) you’re going to need a cash injection from an investor like Clearco. With an investment, you’re able to focus on growth without worrying about running out of critical funds.

3 Reasons to pay attention to your cash flow runway:

- So you know when you're ready to introduce new channels to your marketing mix. If you’re an eCommerce store ready to go from one channel (or no channels) to multiple ad channels, you have to be prepared to take on additional costs. If your burn rate has increased by $10,000 every month because you have added in paid advertising, you’ll want to ensure your cash/burn rate ratio is sustainable up until the point when you start seeing a return on investment.

- You need upfront or additional investment for store inventory. Unless you’re running a dropshipping business, you’re going to want to have inventory on hand to sell. For some stores, the inventory might be cheap and easily attainable, but for others, the cost can be too much. This leads to low stock and out-of-stock issues for potential customers that impact your sales in the long run.

- You’re ready to establish foundations for sustainable, long-term growth. Growth requires that you gain traction (repeatable patterns that lead to conversion) and iterate on those successes over time. Find traction takes time, testing, and resources. One Facebook ad that generates 20 sales is nice, but one Facebook ad that’s been tweaked and tested over time to generate 20 sales each day is even better. With a longer cash flow runway, you will have more freedom to uncover strategies for long-term profitable growth.

Frequently asked questions about eCommerce store funding

How can I know if it’s time to re-evaluate my funding?

You should check your cash flow runway frequently. Is your burn rate increasing? Do you have the funds on hand to keep your store live for 3 months? 6 months? 9 months? If you’re constantly short on cash and short on time trying to keep up with your invoices and billing, you should consider seeking opportunities to inject your business with additional cash.

What steps should I take if I’m running out of money?

This is a tough question! If you’re running out of money and your cash flow runway has become a cash flow parking lot, there are still steps you can take to keep your business afloat. First, you should look at cutting immediate expenses to save on costs. You can also look at what inventory you have existing and run a sale for a product you have a lot of inventory for to get a quick injection of cash. And, finally, if you qualify for funding from reputable eCommerce investors, like Clearco, we would encourage you to jump on the opportunity!

How much can I expect to spend on an ad channel?

In short: it depends. The answer comes down to how realistic your goals are in relation to the channel fit. In other words, the less proven a channel is for a business, the more they should expect to spend on that channel before they start seeing positive returns.

How do I know what channels to invest in?

There are so many digital advertising channels and, if you’re not careful, it can be easy to overspend on strategies that just aren’t working for you. There is such a thing as growing too fast, and that often comes from investing in too many channels that aren’t bringing returns

Maybe you're investing in Facebook, TikTok, Pinterest, and Snapchat, but in reality, you should only be investing in one. Usually, for our eCommerce clients, we recommend advertising on Facebook. Facebook (which also includes Instagram ads) is a powerful platform for testing and selling products. It’s a great starting point for testing a lot of messaging, position, and pricing. Ha.ving one solid platform that can give you valuable insights into how your funnel is performing gives key findings that can be used to expand to other channels. This approach also gives you early benchmarks to test against when you’re figuring out your advertising budget.

Before embarking on any new marketing initiative, you should consider what the impact would be if it:

- A) brings in $0 in revenue and completely bombs

- B) breaks even, generating just enough revenue to cover the costs of the effort

If the result of those scenarios is that the business goes under or is irreparably damaged, don't do it. That's not experimenting or taking a risk, that's gambling.

If you’re curious about strategic ways to turn your cash flow runway into a growth runway with sustainable growth systems, book a discovery call with our team to get started!

-AK-148968-preview.png?width=842&height=310&name=1.01-1x1px-Embertribe-(Client-Services)-AK-148968-preview.png)

.png?width=810&height=810&name=TJ%20Jones%20-%20%20CoFounder%20EmberTribe%20(1).png)

%20-%20500x500%20-%20SP%20-%2045.01.png)

%20-%20500x500%20-%20SP%20-%2049.01.png)

%20-%20500x500%20-%20SP%20-%2057.01.png)

.png)